Your credit score can help you buy a house, get a loan, or even just finance a new phone. Here are a few ways to keep track of it.

There are few things more important to maintain than your credit score. Whether you're applying a new credit card, a house, or a phone line, your credit score will be an instrumental factor in your approval odds. If your credit score is too low, you may have to pay an astronomical security deposit — if you're able to get approved at all.

Needless to say, a poor credit score can be hugely detrimental, so save yourself some trouble and start monitoring your credit so you can take control of your score. Whether you have outstanding credit or you just went through your third bankruptcy, it never hurts to have an idea of your credit situation, and it's never too late to start working to improve it.

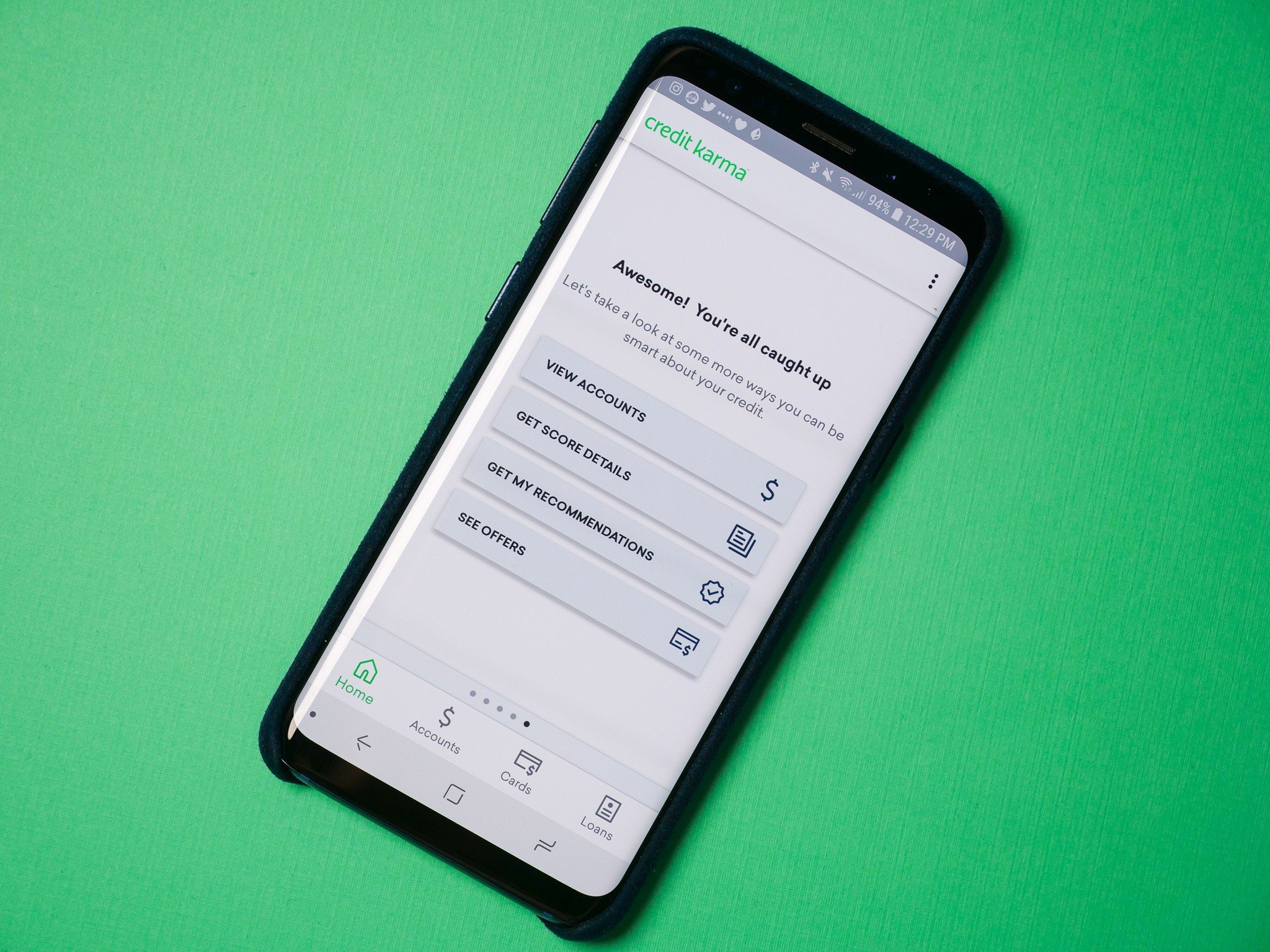

Credit Karma

If there's any one app you should use to monitor your credit score, it's without a doubt Credit Karma. This free service shows your TransUnion and Equifax scores, along with breakdowns of any credit lines on your record — that includes credit cards, auto loans, personal loans, and more. It also provides tools to help you improve your credit, as well as suggestions for new loans and credit cards you might qualify for.

While it's a bit late in the year, you can even file your taxes through Credit Karma. Unlike Intuit (who makes TurboTax), Credit Karma doesn't charge any fees for filing through its services — that means it also doesn't bug you to try a paid version half a dozen times when you're trying to file. I opted to try Credit Karma's filing service for the first time this year after comparing results with TurboTax, and it worked just as well as you would expect.

Credit Sesame

If you don't mind paying a bit for a premium membership, Credit Sesame can offer more information than Credit Karma, pulling credit reports from all three bureaus with a paid account. You can still see your Vantage 3.0 score with a free membership, however, and Credit Sesame has the added benefit of identity protection — even providing up to a million dollars of identity theft coverage at higher paid tiers. Even with a free account, though, you get $50,000 in coverage.

Download: Credit Sesame (free)

Mint

Mint is another great service that helps you keep track of all of your finances in one place. It's made by Intuit, so you can sign in with your TurboTax info, and you can link any of your financial accounts (banking, credit cards, utilities and bills, etc.) to Mint to monitor your spending. It breaks your monthly spending into a pie chart, and displays your cash flow in and out.

Like Credit Karma, Mint shows you your Vantage 3.0 credit score as provided by TransUnion, and offers suggestions for various credit cards and loans. You can customize your Overview page in the settings to only display the information you care about, and set up push notifications or emails for upcoming bill alerts — you can even use Mint to create a calendar for your bills.

Your credit card

Most credit card companies these days offer free credit monitoring from within their apps. Most will display your FICO score, but it can vary from bank to bank. In fact, some banks don't even require that you be a customer to get a free credit report — Discover is a prime example with its popular Credit Scorecard service.

Plenty of other banks do this, as well. Chase provides you with your Vantage 3.0 score, as does Capital One (you don't have to be a customer of either bank to check your score), while banks like American Express, Citibank, and Wells Fargo all display your FICO score.

What do you use?

Do you use one of the apps mentioned here, or is there another app you depend on for monitoring your credit score? Let us know in the comments below!

Tidak ada komentar:

Posting Komentar